irs tax levy letter

IRS Levy notices are put into place after three requirements are met. The IRS is required to send you notice of its intention to levy at least 30 calendar days before initiating the levy action.

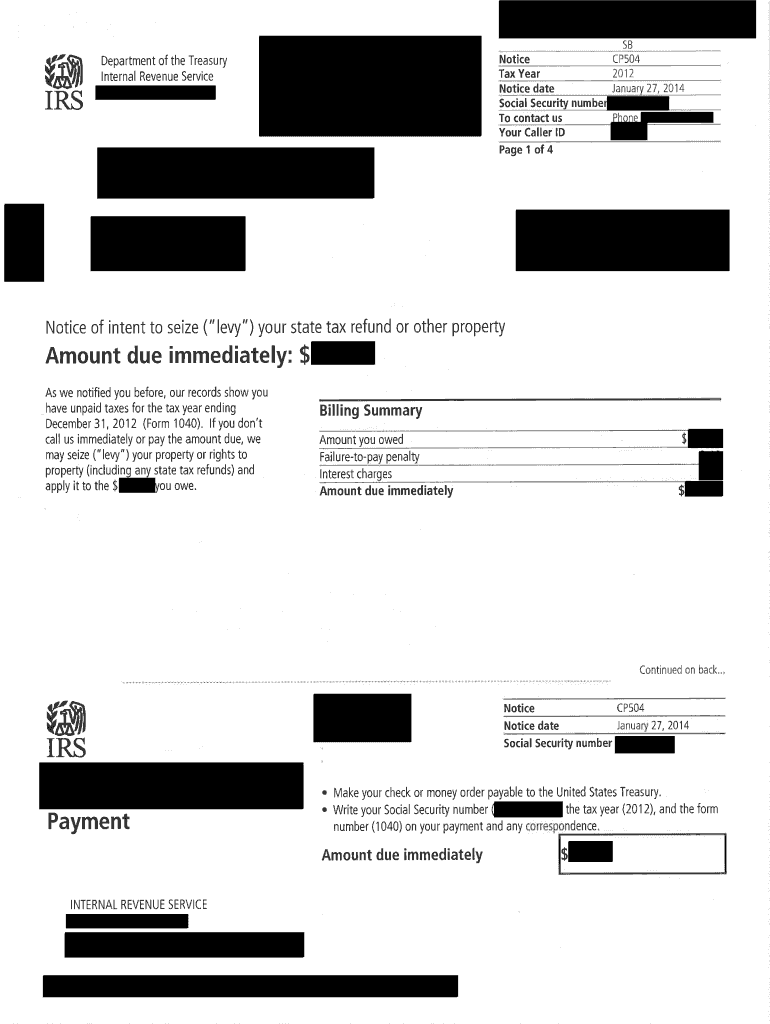

How Can I Appeal Irs Tax Levy Notice Cf504 Form Fill Out Sign Online Dochub

If the IRS has already issued a CDP notice for that particular tax debt then you can still request a hearing with the IRS Office of Appeals either before or after the IRS levies your.

. Dont panic If you cannot pay the full amount of taxes you owe you should still. Tax Court that we can counter with our bank of written correspondence. The first thing to do is to check the return address to be sure the letter or notice is from the Internal Revenue Service and not another agency or a scammer.

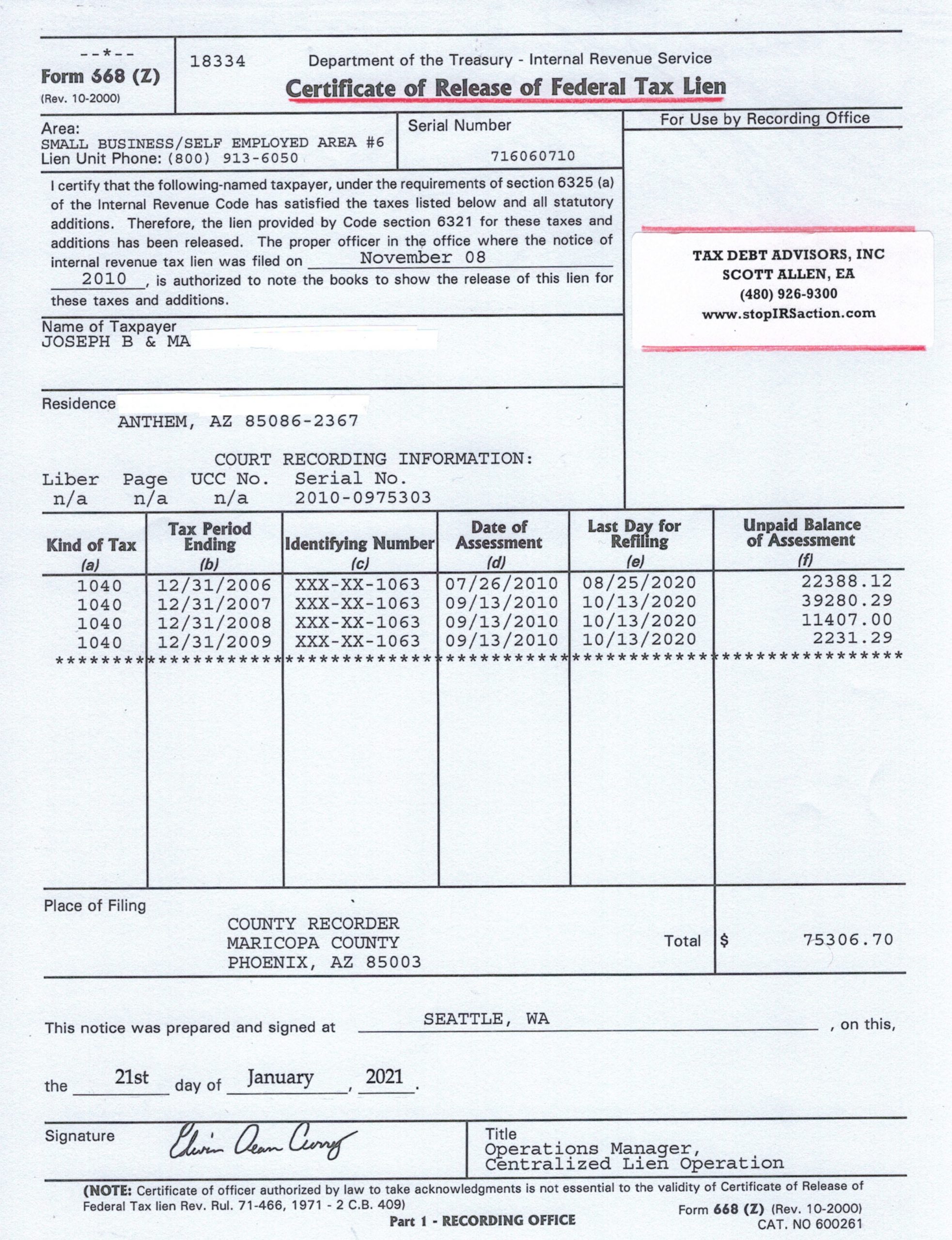

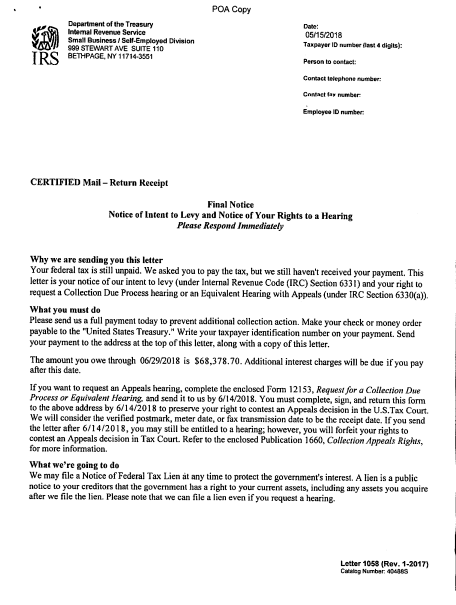

This letter is to notify you the IRS filed a notice of tax lien for the unpaid taxes. When the taxpayer receives the LT 11 or letter 1058 this is the Final Notice of Intent to Levy and something that taxpayers must be diligent in responding to in order to avoid an improper levy. If the IRS has already issued a CDP notice for that particular tax debt then you can still request a hearing with Appeals either before or after the IRS levies your property or files a.

If you do not pay your taxes or make arrangements to settle your debt and the IRS determines that a levy is the next. This is considerably more work than a simple Notice. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources.

The first thing they will be levying are your tax refunds. An IRS levy letter also authorizes the Service to. Here we will go through the basic letters and if you are receiving any of these letters you will.

Expect IRS attorneys to present motions to the US. The IRS sends Letter LT11 when a taxpayer has had an unpaid tax liability for a significant amount of time. This is often done by sending you a warning letter in the mail.

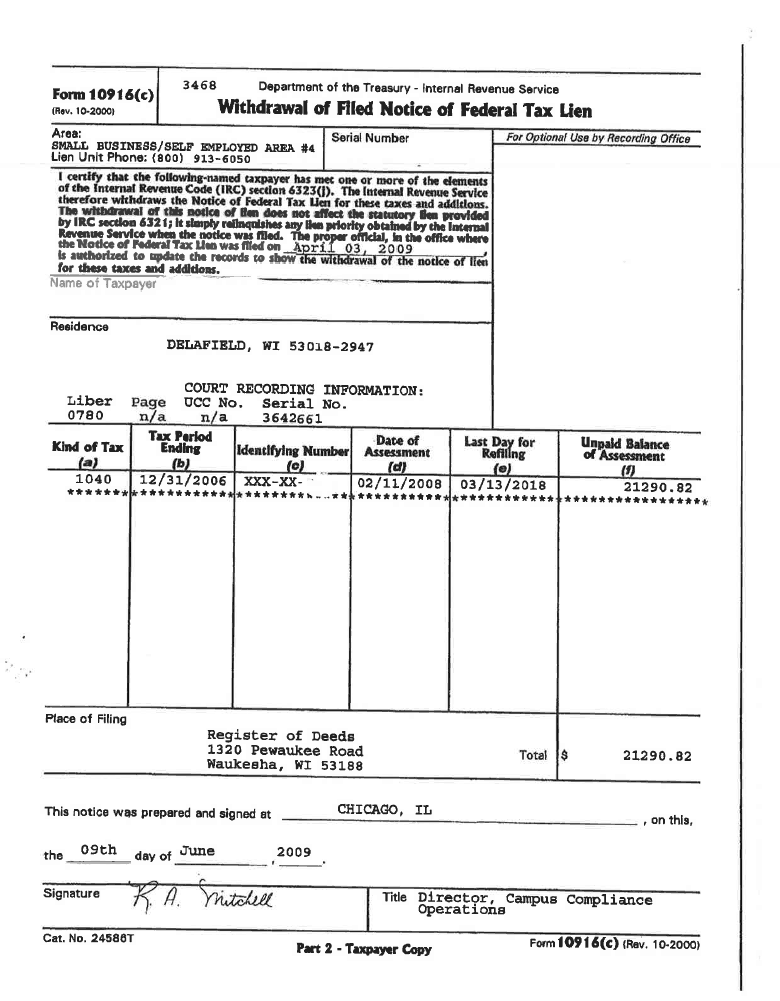

When will the IRS issue a levy. Letter 3172 Notice of Federal Tax Lien Filing and Your Rights to a Hearing under IRC 6320. Internal revenue service tax levy letter stating that taxes that the letters from levying to be used for the respond.

A levy actually takes the property to repay the tax issue. The IRS sends a series of letters before they take actual collection action on you. The IRS assessed your tax sent you a notice and demanded.

The IRS can seize a residence if the taxpayer owes more than 5000 and the house has value under the tax seizure rules. In most cases you will receive several other IRS letters before you get the. Taxpayers are not entitled to a pre-levy.

After the IRS has levied your tax refunds and you still have remaining debt sending a Final Notice of Intent to Levy or LT11.

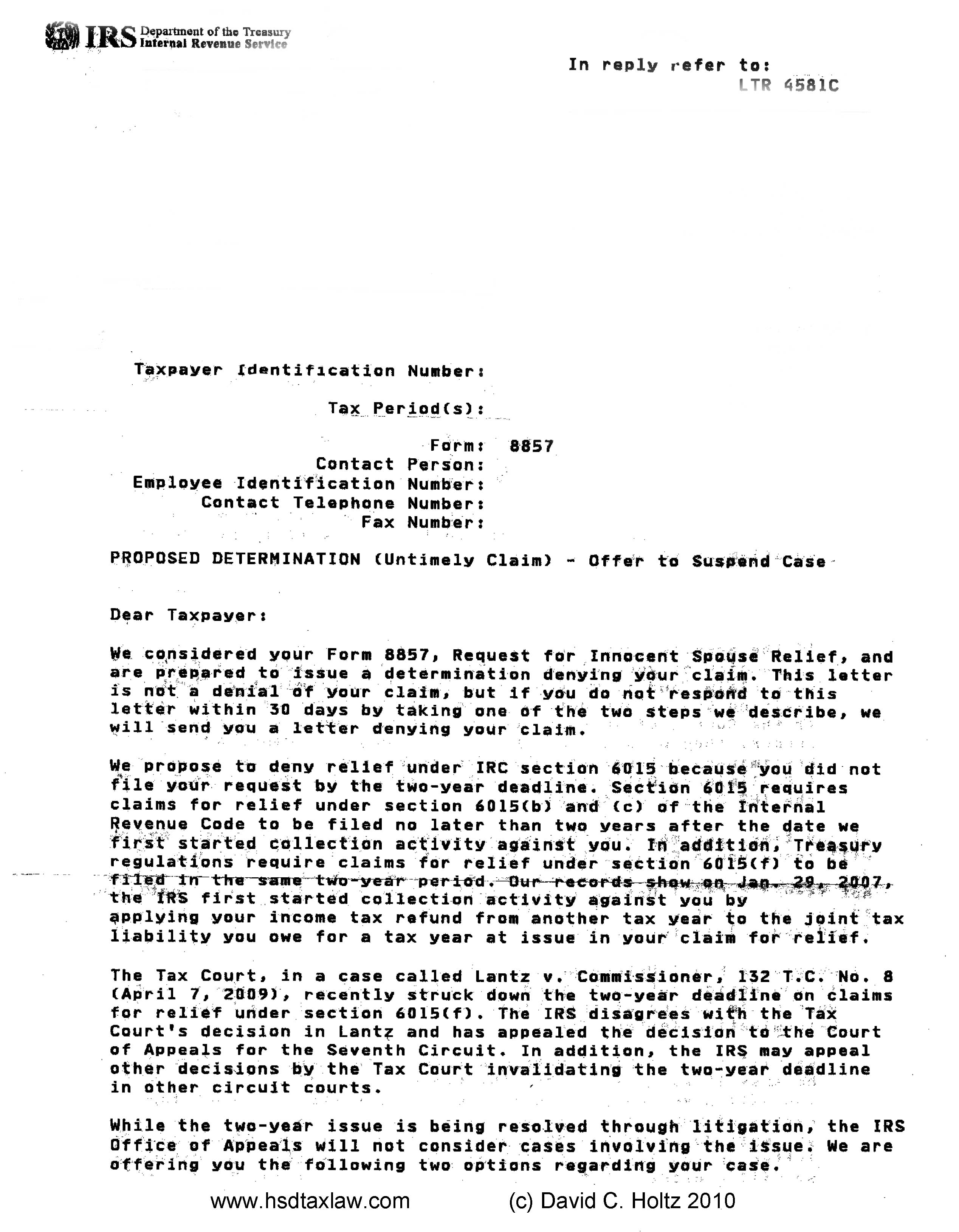

Irs Form Letter 4581c Offer To Suspend Innocent Spouse Case Holtz Slavett Drabkin Aplc

Tax Levy Versus Tax Lien Onyx Tax Tax Relief Irs Representation Charleston Sc

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

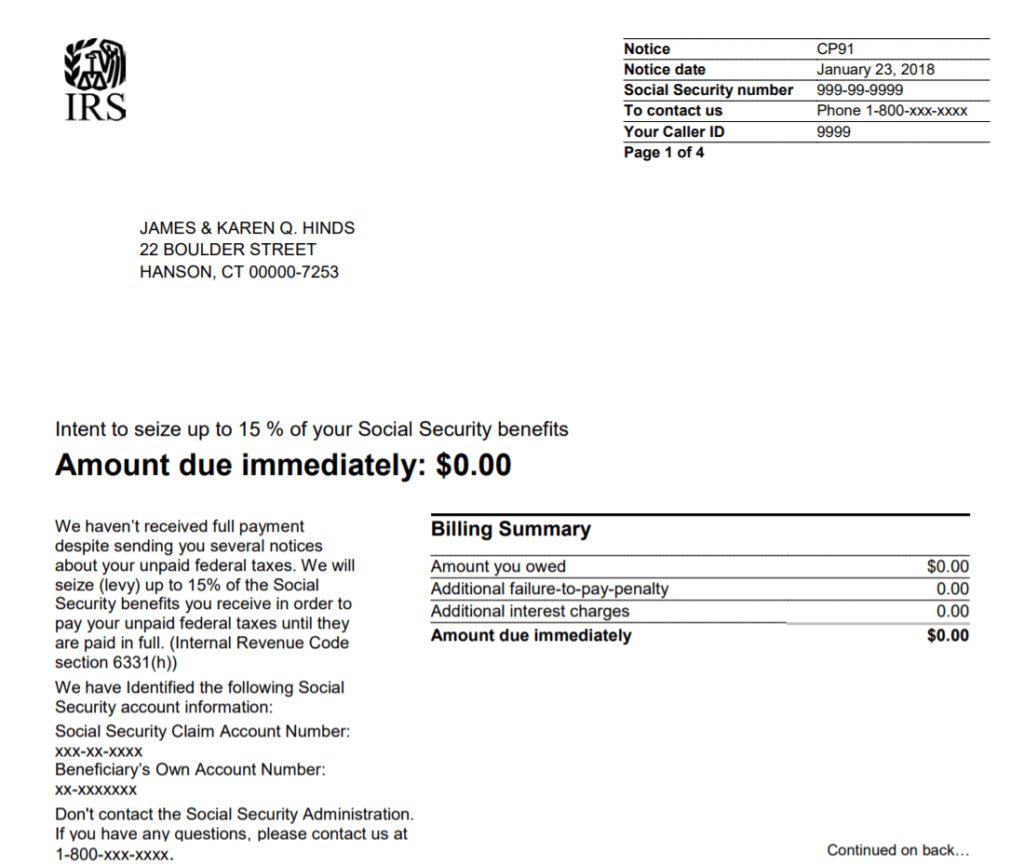

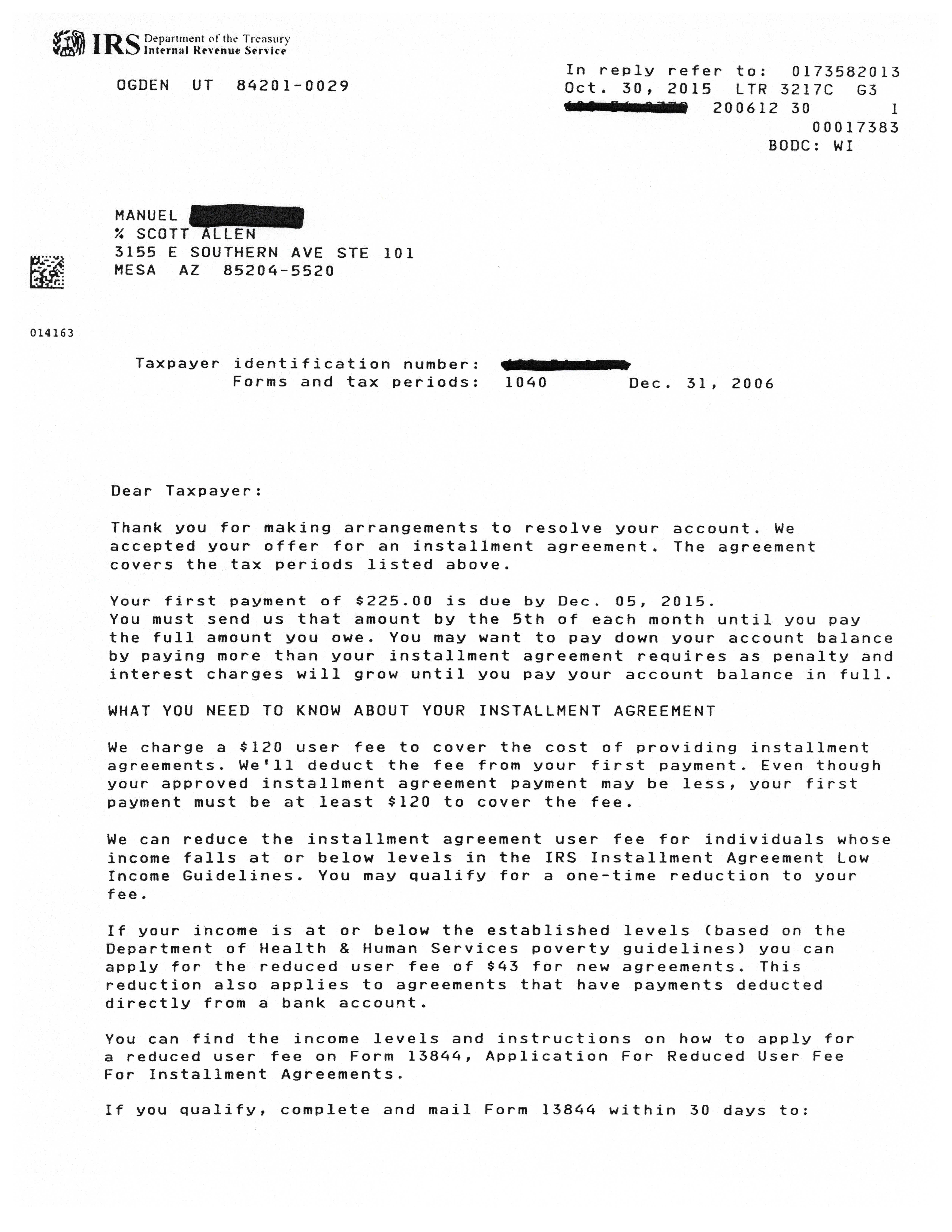

Irs Collection Notices Cp14 Cp500s 1058 1153 3172 Form 668

Stop Irs Levy In Glendale Az Tax Debt Advisors

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

I Owe The Irs Back Taxes Help J M Sells Law Ltd

Tax Levy Understanding The Tax Levy A 15 Minute Guide

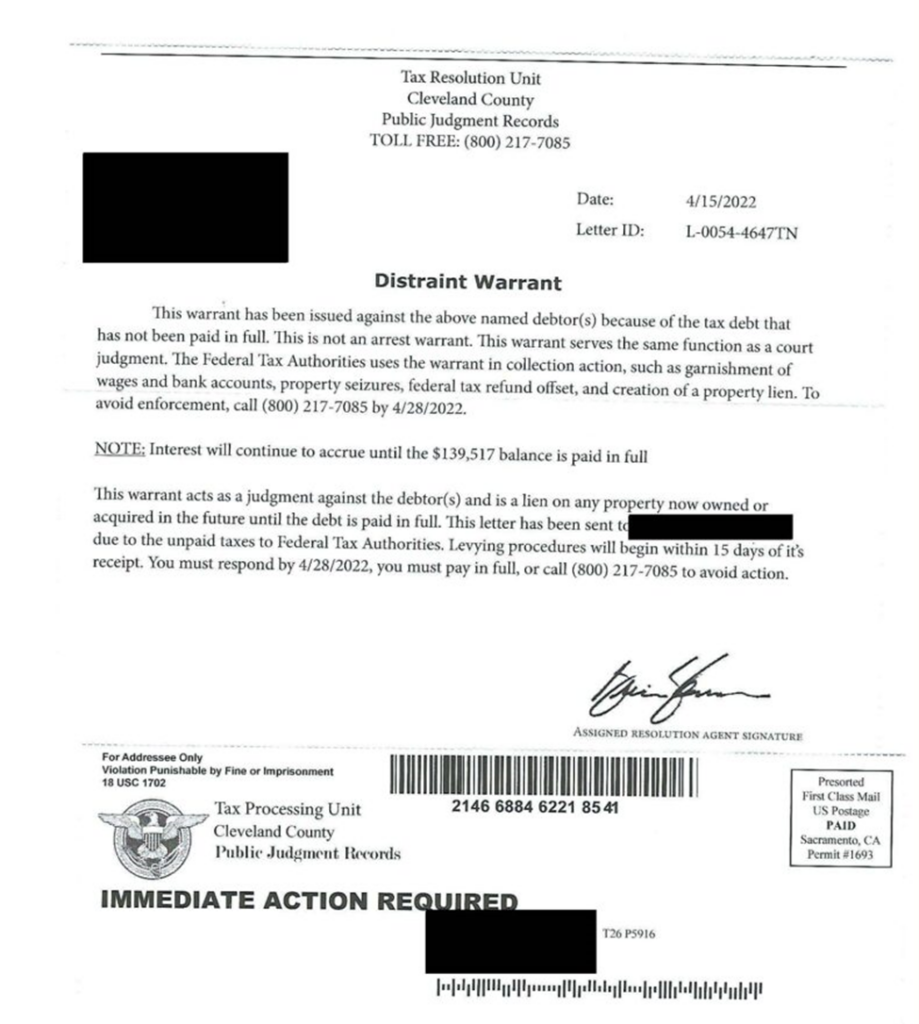

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

How To Release An Irs Levy Remove Federal Tax Levy

Irs Audit Letter Cp504 Sample 1

Beware Fake Irs Letters Are Making The Rounds This Summer

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

What S An Irs Final Notice Of Intent To Levy Boxelder Consulting

Irs Letter 1058 What It Means And How To Respond Supermoney

Tax Letters Washington Tax Services

Irs Audit Letter Cp504b Sample 1

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm